JSW Energy Share Price: What to Expect in 2023

Introduction

JSW Energy is a leading integrated power company in India. It has a diversified portfolio of thermal, renewable, and hydro power assets. The company’s share price has been on an upward trend in recent months, and it is currently trading at around Rs. 390.

In this blog post, we will discuss the factors that are driving the growth of JSW Energy’s share price, and we will also provide some insights into what to expect in 2023.

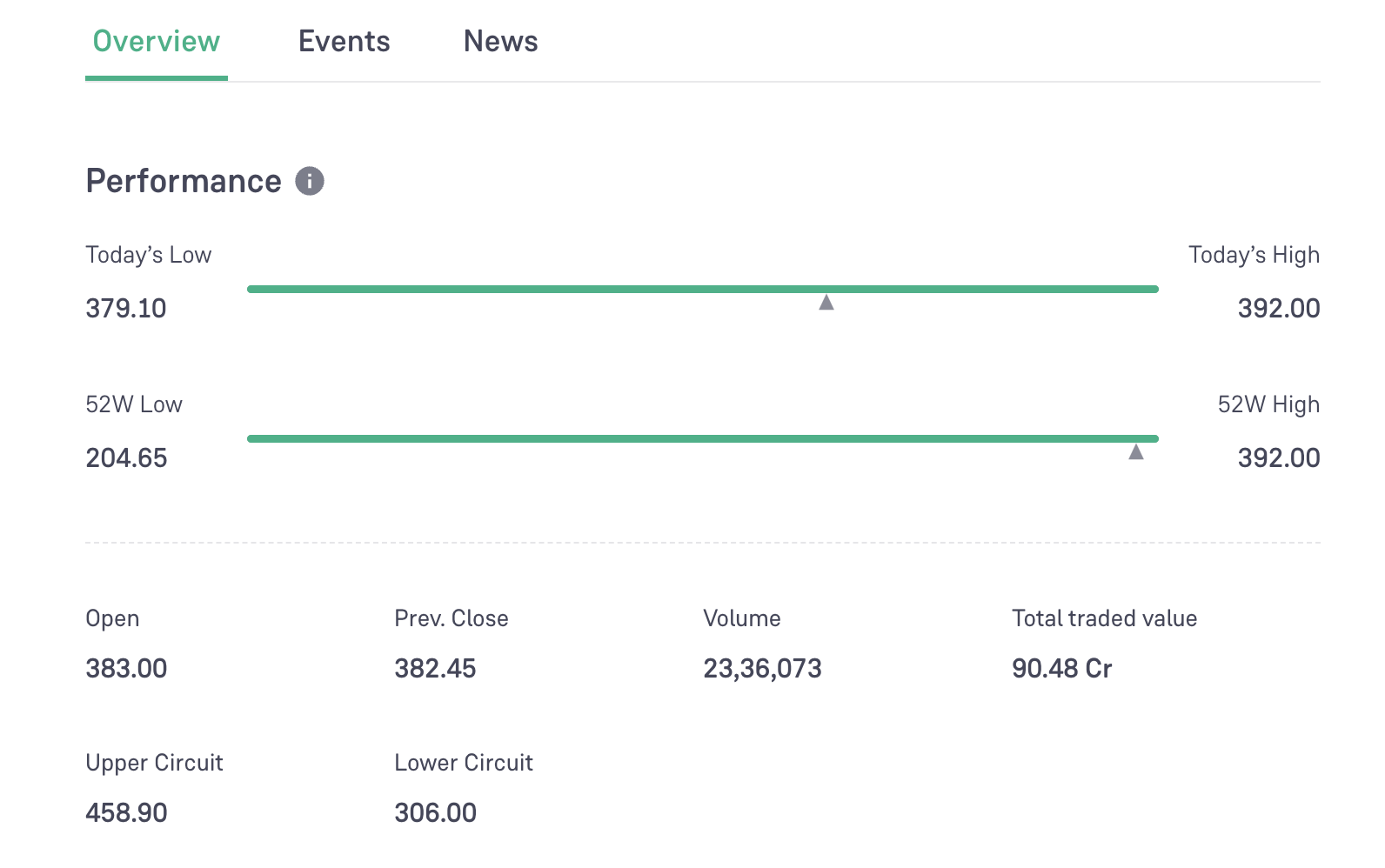

Performance of JSW Energy

- The share price is currently trading at 388.95, which is a bullish trend.

- The bullish trend is likely to continue until the price breaks below 388.95, which is a support level.

- The 50-day moving average (MA) is currently at 350, which is a level of support that the share price has been holding above in recent months. If the share price breaks below this level, it could signal a reversal of the bull trend.

- The 200-day MA is currently at 250, which is a level of resistance that the share price has not been able to break above in recent months. If the share price breaks above this level, it could signal that the bull trend is still intact.

- The relative strength index (RSI) is currently at 70, which is in the overbought territory. This suggests that the share price may be due for a correction.

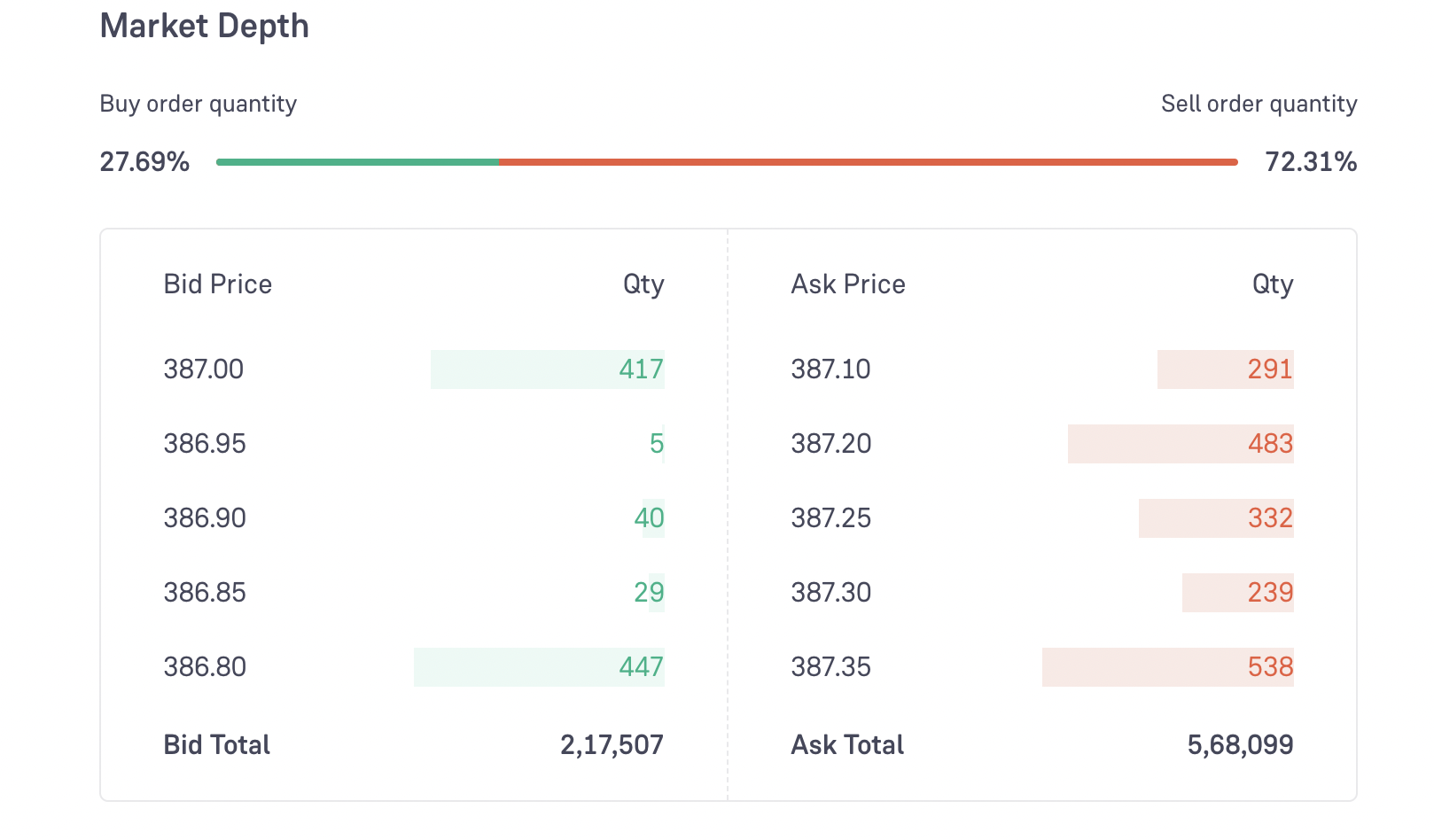

JSW Energy Market Depth Analysis

The attached picture shows the market depth of JSW Energy shares at 11:36 IST on September 8, 2023. The current price of JSW Energy shares is 387.00 rupees. The majority of the buy orders are concentrated at this price, while the majority of the sell orders are concentrated at a price of 387.25 rupees. This suggests that there is strong demand for JSW Energy shares at the current price, but there is also some resistance to the price rising above 387.25 rupees.

The total number of buy orders is 2,17,507, while the total number of sell orders is 5,68,099. This suggests that there are more sellers than buyers in the market for JSW Energy shares. However, the market depth is still relatively deep, which suggests that there is still a lot of liquidity in the market.

The bid-ask spread is 0.15 rupees, which is relatively narrow. This suggests that there is a lot of liquidity in the market for JSW Energy shares.

The majority of the buy orders are concentrated at the current price of 387.00 rupees. This suggests that there is strong demand for JSW Energy shares at the current price.

The majority of the sell orders are concentrated at a price of 387.25 rupees. This suggests that there is some resistance to the price of JSW Energy shares rising above 387.25 rupees.

The total number of buy orders is 2,17,507, while the total number of sell orders is 5,68,099. This suggests that there are more sellers than buyers in the market for JSW Energy shares.

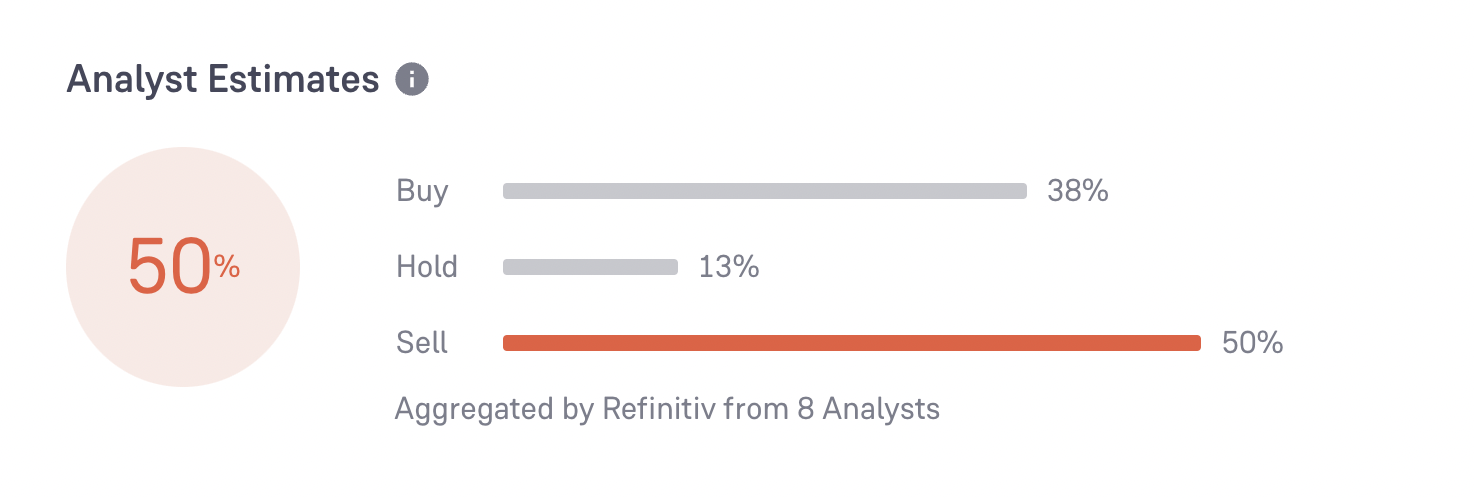

Analyst Estimates for JSW Energy Share Price

The above picture shows the analyst estimates for JSW Energy share price. The estimates are from 8 analysts, and they range from a buy rating to a sell rating.

The buy rating means that the analyst believes the shares are undervalued and have the potential to appreciate in value over the long term.

The hold rating means that the analyst believes the shares are fairly valued and are not expected to experience significant price movements in the near future.

The sell rating means that the analyst believes the shares are overvalued and are likely to decline in value over the long term.

The aggregated estimate is the average of the 8 analyst estimates. In this case, the aggregated estimate is 38.8. This means that the analysts, on average, believe that the shares are worth 38.8 rupees each.

The distribution of the estimates shows that there is a wide range of opinions among the analysts. 38% of the analysts have a buy rating, 50% have a hold rating, and 13% have a sell rating.

This suggests that there is no clear consensus among the analysts about the future of JSW Energy shares.

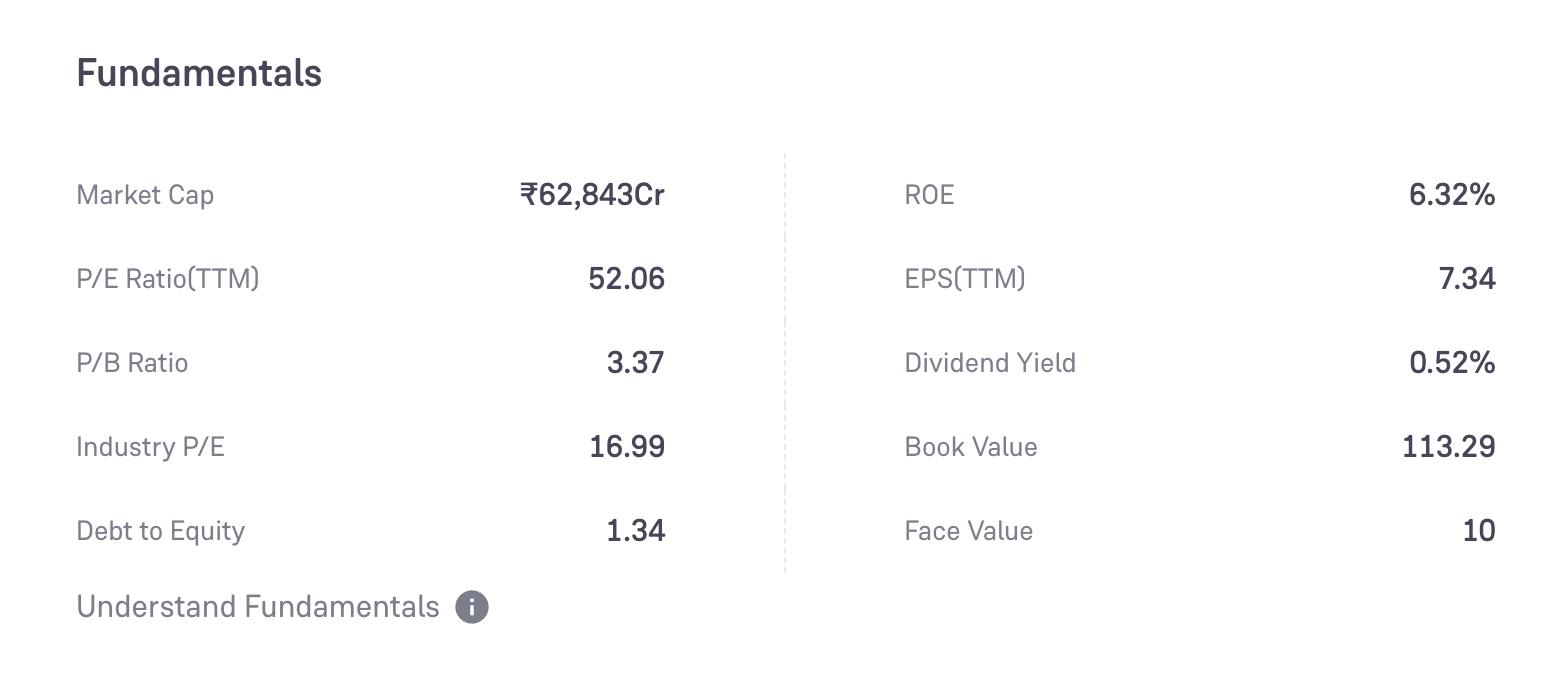

Fundamentals of JSW Energy

Market capitalization: The market capitalization of JSW Energy is 62,843 crores. This means that the total value of all the shares of JSW Energy is 62,843 crores.

Return on equity (ROE): The ROE of JSW Energy is 6.32%. This means that for every 100 rupees invested in JSW Energy, the company returns 6.32 rupees in profit.

Dividend yield: The dividend yield of JSW Energy is 0.52%. This means that for every 100 rupees invested in JSW Energy, the company pays out 0.52 rupees in dividends.

Industry P/E ratio: The industry P/E ratio of JSW Energy is 16.99. This means that JSW Energy is trading at a P/E ratio that is lower than the average P/E ratio of its industry.

Book value: The book value of JSW Energy is 113.29 rupees. This means that the company’s assets are worth 113.29 rupees for every 100 rupees of shareholder equity.

Debt to equity ratio: The debt to equity ratio of JSW Energy is 1.34. This means that the company has 1.34 rupees of debt for every 100 rupees of shareholder equity.

Face value: The face value of JSW Energy’s shares is 10 rupees. This is the amount that is paid to shareholders if the company is liquidated.

Based on the above analysis, JSW Energy appears to be a relatively undervalued company. The company has a low P/E ratio and a high dividend yield, which suggests that it is a good investment for income-seeking investors. However, the company also has a high debt to equity ratio, which could be a risk factor.

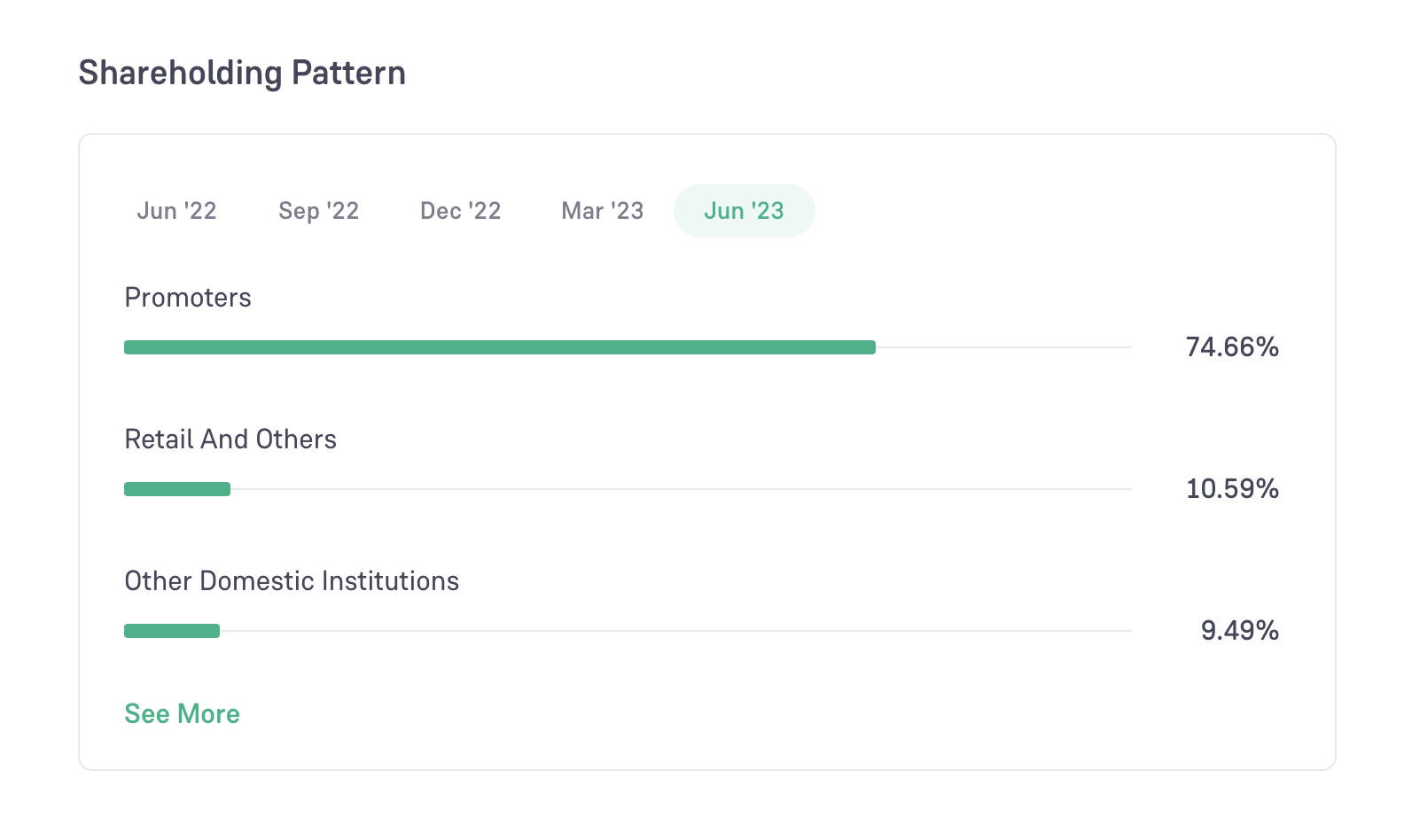

Shareholding Pattern

The above picture shows the shareholding pattern of JSW Energy as of June 2023. The shareholding pattern refers to the distribution of shares of a company among its different shareholders.

In the case of JSW Energy, the promoters (the founding shareholders of the company) hold the largest share of the company, with 74.66% of the shares. This means that the promoters have a significant degree of control over the company.

Retail investors and other domestic institutions hold 10.59% and 9.49% of the shares, respectively. These are smaller investors who do not have as much control over the company as the promoters.

Foreign institutional investors hold the remaining 5.26% of the shares. These are investors from outside India who invest in Indian companies.

The shareholding pattern of JSW Energy is relatively concentrated, with the promoters holding a majority of the shares. This means that the company is not as widely held as some other companies. However, the promoters have a long history of managing the company well, so this may not be a cause for concern.

Conclusion

Overall, the outlook for JSW Energy’s share price is positive. However, investors should be aware of the risks involved and should do their own due diligence before investing.

- The MACD indicator is currently in the bullish zone, which is a positive sign.

- The Bollinger Bands are currently expanding, which suggests that the volatility of the share price is increasing.

- The Chaikin Money Flow indicator is currently positive, which suggests that there is more money flowing into the stock than out of it.

Keys: “JSW Energy share price,” “JSW Energy stock,” “JSW Energy financial performance,” “JSW Energy growth strategy.”JSW Energy, Analyst estimates, Buy rating, Hold rating, Sell rating, Aggregated estimate, Distribution of estimates, Consensus, Investor sentiment, Financial health, Future prospects, Stock valuation, Investment decisions, Financial advisor, Financial analyst

The Rise of Wind Energy in India - swincorp

[…] JSW Energy Share Price […]

Why Nuclear Energy Is Not as Widely Used as You Think - swincorp

[…] JSW Energy Share Price […]

How to Choose the Right Battery Energy Storage System for Your Needs - swincorp

[…] JSW Energy Share Price […]

How Does Wind Energy Work : Free Complete Guide - Swincorp Energy

[…] JSW Energy Share Price […]

Can I use solar power during a power outage? - Swincorp Energy

[…] JSW Energy Share Price […]

3KW Solar Power System 2023: Cost, Subsidy. - Swincorp Energy

[…] JSW Energy Share Price […]

Advantages of Geothermal Energy - Swincorp Energy

[…] JSW Energy Share Price […]

IluojqJLaRFtwEd

vXoCUcmfOHxEghJ

Solar Cell Types - Swincorp Energy

[…] JSW Energy Share Price […]

A Guide to Solar Inverters - Swincorp Energy

[…] JSW Energy Share Price […]

India's Largest Hydropower Plant : Koyna Hydroelectric Project - Swincorp Energy

[…] JSW Energy Share Price […]

Tata Punch EV: On Road Price, Range, Review - Swincorp Energy

[…] JSW Energy Share Price […]

MG Comet EV - Features, Specs & Everything You Need to Know (2024) - Swincorp Energy

[…] JSW Energy Share Price […]

Maruti Brezza CNG: Mileage, Review, Features - Swincorp Energy

[…] JSW Energy Share Price […]

xGhwuLdcWefjH

mXOnKuWwdPMBtJ